Renters Insurance in and around Russellville

Welcome, home & apartment renters of Russellville!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Russellville

- Phil Campbell

- Bear Creek

- Franklin County

- Littleville

- Red Bay

- Tharptown

Insure What You Own While You Lease A Home

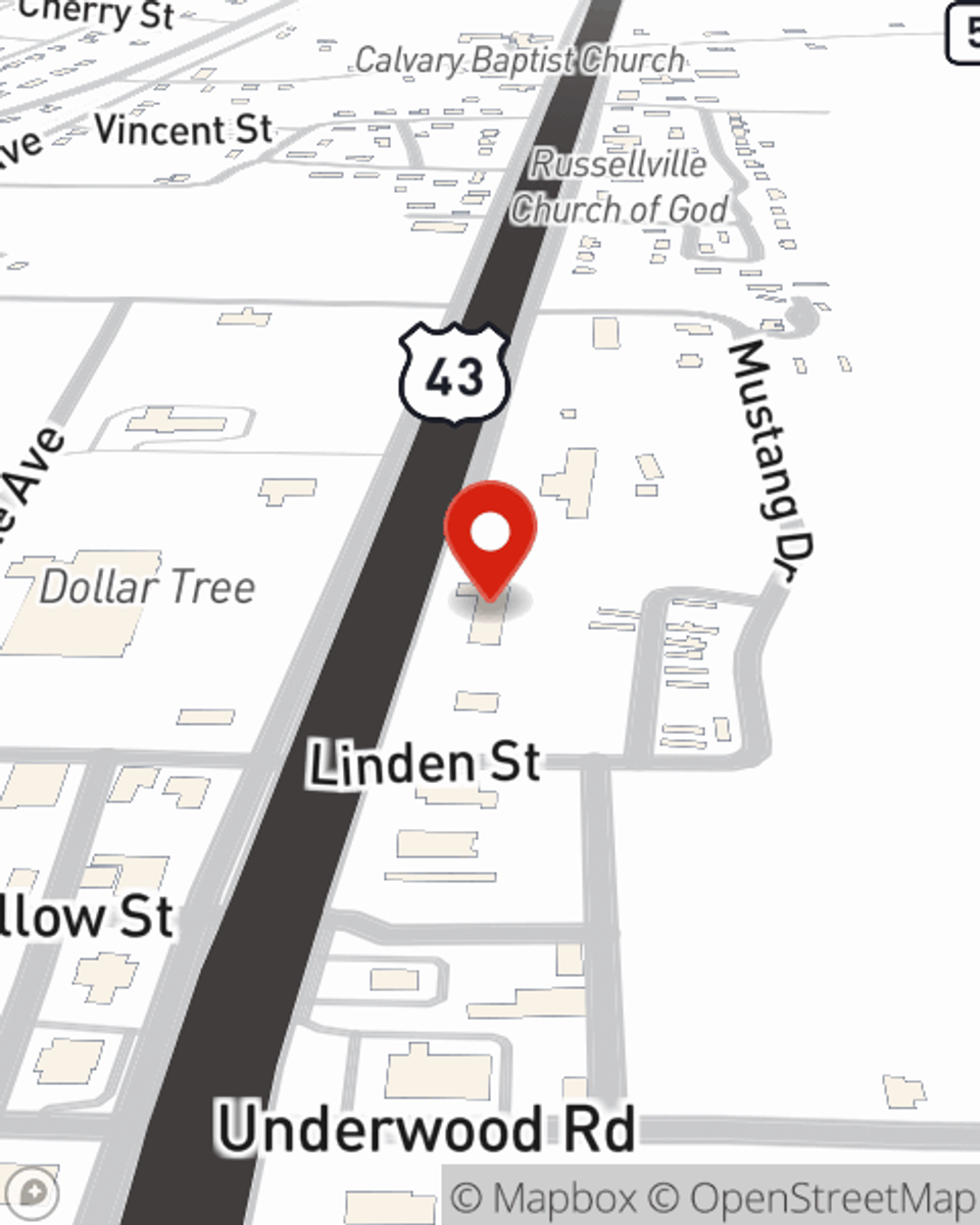

Being a renter doesn't mean you are 100% carefree. You want to make sure what you own is protected in the event of some unexpected mishap or accident. And you also need liability protection for friends or visitors who might become injured on your property. State Farm Agent Diana Lockmiller is ready to help you handle the unexpected with reliable coverage for your renters insurance needs. Such personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If if trouble knocks on your door, Diana Lockmiller can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Welcome, home & apartment renters of Russellville!

Rent wisely with insurance from State Farm

Safeguard Your Personal Assets

When the unanticipated break-in happens to your rented condo or space, generally it affects your personal belongings, such as a set of golf clubs, a video game system or a microwave. That's where your renters insurance comes in. State Farm agent Diana Lockmiller can help you evaluate your risks so that you can protect yourself from the unexpected.

It's always a good idea to be prepared. Call or email State Farm agent Diana Lockmiller for help understanding savings options for your rented unit.

Have More Questions About Renters Insurance?

Call Diana at (256) 332-SAVE or visit our FAQ page.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Diana Lockmiller

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.